The Rise of Local Stablecoins in Africa

Inside the rise of stablecoins as Africa’s new financial infrastructure

Across Sub-Saharan Africa, access to U.S. dollars has become a privilege. Central-bank reserves are strained, import demand is high, and foreign-exchange markets are chronically illiquid. Nearly 70 percent of African economies face some form of FX shortage, a quiet crisis that shapes everything from trade to tuition payments.

For businesses and households alike, local currencies offer little protection. The naira lost more than 60 percent of its value in 2024, while Ghana’s cedi and Egypt’s pound fell sharply too. Saving in local currency often feels like watching value evaporate.

Out of this pressure emerged a digital alternative: stablecoins. Dollar-pegged tokens such as USDT and USDC provide the stability and global reach of the greenback without the gatekeepers. They have become the dollars Africans can actually access, powering trade, remittances, and payrolls in ways the formal banking system no longer can.

Today, stablecoins account for roughly 43 percent of all crypto transactions in Sub-Saharan Africa. What started as a niche workaround for freelancers and families has become a financial backbone for entire economies, not speculation, but survival engineering

How Businesses Run on Stablecoins

What began as a workaround for individuals has evolved into a quiet, continent-wide operating system for business. From micro-retailers to multinational suppliers, stablecoins are becoming the rails on which African commerce runs.

Stablecoins have become the default medium for cross-border value transfer in a dollar economy without the paperwork.

Fintech platforms are scaling this infrastructure. Yellow Card, which operates in over 20 African countries, enables businesses to convert between fiat and stablecoins with a single API call. Stablecoins lets you move money faster, cheaper, and more reliably than the banking system ever could.

Across e-commerce, gig work, and logistics, these digital dollars now do what the real ones cannot: move freely. A new dollar economy is forming: decentralized, programmable, and distinctly African in its ingenuity.

The Rise of Local Stablecoins

The first chapter of Africa’s stablecoin story was about survival, importing the dollar into digital form. The next chapter is about sovereignty.

A new wave of natively issued stablecoins is emerging across the continent, this time pegged not to the U.S. dollar but to local currencies. These include:

cGHS – Ghanaian Cedi

cNGN – Nigerian Naira

cZAR/ZARP – South African Rand

cKES – Kenyan Shilling

eXOF – West African CFA Franc

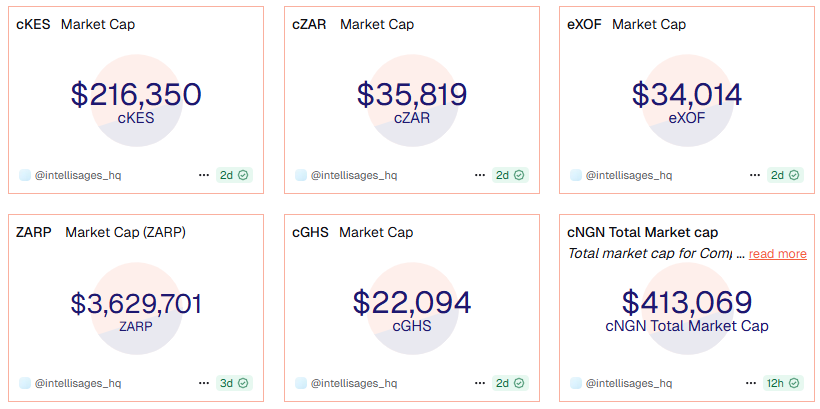

As of October 2025, IntelliSage’s data provides a snapshot of the market capitalizations of leading African stablecoins, offering a sense of their relative scale, liquidity, and economic reach.

ZARP leads Africa’s local stablecoin market with a capitalization of $3.63 million, supported by South Africa’s mature financial infrastructure and vibrant cross-border trade ecosystem.

cNGN follows with $413,000, reflecting steady growth within Nigeria’s dynamic yet tightly regulated digital asset landscape. cKES stands at $216,000, driven by remittance flows and integration with Kenya’s established mobile money networks.

Meanwhile, cZAR, another rand-pegged token, holds a niche market cap of $36,000, complementing ZARP’s broader reach. eXOF, integrated across select West African banking systems, maintains $34,000, while cGHS rounds out the list at $22,000, highlighting early-stage experimentation within Ghana’s emerging fintech scene.

Collectively, these figures highlight uneven adoption across regions, with institutional strength in certain markets still outpacing broader retail participation.

Unlike their dollar-backed predecessors, these tokens are designed for domestic commerce, paying rent, settling local invoices, or moving money between mobile wallets. They give merchants, workers, and consumers the stability of fiat without the friction of banks.

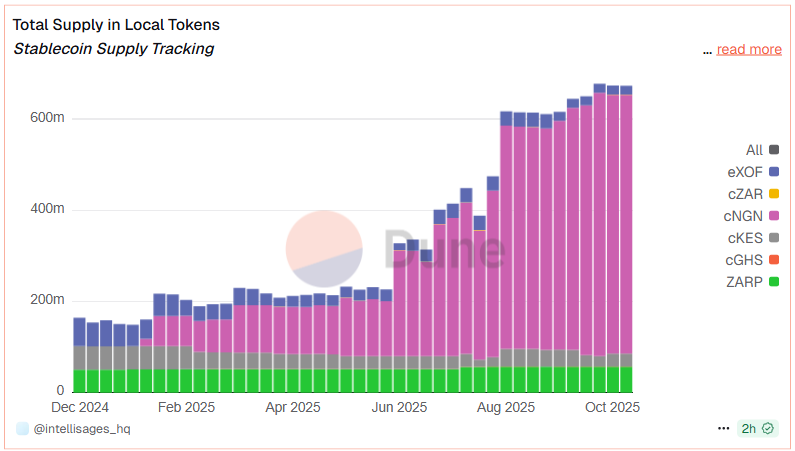

Total Supply Dynamics in African Local Stablecoins

As of October 2025, approximately 672 million local-currency stablecoins have been issued across Africa. The Nigerian naira-backed cNGN dominates the market with 566 million tokens, representing 84.2% of total supply. The South African rand-backed ZARP follows with 58 million tokens (8.6%), while the Kenyan cKES holds 28 million tokens (4.2%) in circulation.

Other regional stablecoins, including eXOF, cZAR, and cGHS, collectively account for the remaining 3% of total issuance.

While US-pegged coins like USDT and USDC connect Africa to global liquidity, these homegrown stablecoins strengthen financial inclusion within Africa, digitizing local economies, enabling micro-transactions, and creating seamless payment rails between citizens, merchants, and fintechs.

After importing the digital dollar, Africa is now exporting its own digital money.

This shift marks the beginning of a uniquely African financial mode, one where value circulates locally before it flows globally.

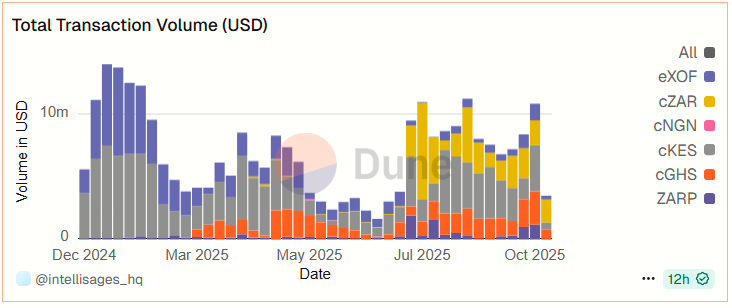

Transaction Volume Reveals Real Usage

The chart below shows monthly transaction volumes (in USD) for major African stablecoins. Early activity was dominated by eXOF, which drove volumes to a peak of around $7 million in late 2024 before tapering off by mid-2025, likely reflecting early cross-border integrations losing momentum amid regulatory or adoption hurdles.

From July 2025 onward, volumes rebounded strongly, led by cZAR, which reached new highs near or above $7 million, followed by cKES and cGHS, each averaging around $1 million.

This renewed and sustained growth, achieved without a significant increase in total supply, suggests real transactional use cases are taking hold. Rather than speculative trading, these stablecoins are now circulating actively for remittances, commerce, and day-to-day payments. The trend underscores their growing role in financial inclusion and the need for continued investment in infrastructure and usage analytics to support broader adoption.

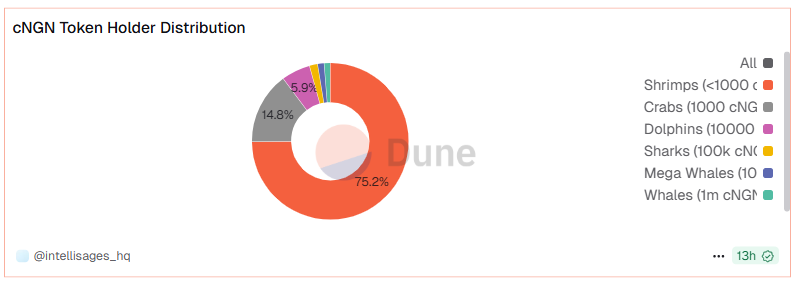

Token Holder dynamics

The cNGN distribution is heavily weighted toward small and mid-sized holders, signaling early grassroots adoption.

Retail participants Shrimps, Crabs , and Dolphins collectively hold over 95% of total wallets, with shrimps alone accounting for 75.2%. Larger holders represent a small minority, together holding less than 10% of addresses.

This pattern suggests broad-based retail participation and growing on-chain distribution, a positive indicator for network inclusivity. While institutional liquidity remains essential for stability, cNGN’s holder spread points to organic community traction and local utility rather than speculative concentration.

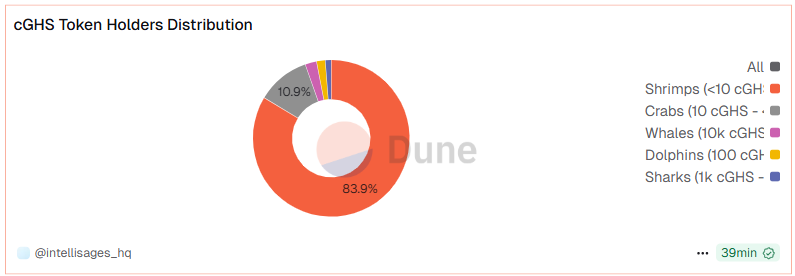

A similar trend appears for cGHS, where small holders dominate supply distribution. Shrimps make up 83.9% of addresses, followed by Crabs at 10.9%.

Whales, dolphins, and sharks collectively represent only a small fraction of holders, underscoring that cGHS is largely retail-driven and community-distributed rather than controlled by a few entities.

This pattern suggests that Ghana’s stablecoin adoption, while still small in total market cap, is more evenly dispersed and grassroots in nature, driven by individuals experimenting with tokenized local currency rather than large-scale institutions.

Conclusion

Across Africa, stablecoins have quietly matured from temporary gateways to dollar liquidity into foundational infrastructure for local economies. What began as a response to chronic foreign-exchange shortages, affecting nearly 70% of regional markets has evolved into a vibrant ecosystem of homegrown tokens such as cNGN, cKES, cZAR, ZARP, cGHS, and eXOF, now collectively surpassing 670 million tokens in circulation.

Transaction volumes reinforce this growth, exceeding $7 million in mid-2025 as usage expands from speculative trading toward everyday commerce, remittances, and cross-border payments.

Yet unlike earlier assumptions of whale concentration, recent distribution data reveal broad-based retail participation, with small holders shrimps, crabs, and dolphins comprising the majority of wallet addresses in tokens like cNGN and cGHS. This shift marks a transition from institutional dominance to a grassroots-driven adoption curve.

This new phase underscores both progress and promise. Stablecoins are emerging as engines of inclusion, digitizing local currencies, enabling frictionless trade, and expanding access to programmable financial tools. To sustain this momentum, stakeholders must focus on strengthening retail infrastructure, enhancing user education, and clarifying regulatory pathways that encourage safe, transparent growth.

Africa’s stablecoin movement is no longer about importing stability, it’s about exporting innovation, building resilient, borderless economies where value flows freely for all.

Data Source: IntelliSages

For more insights, explore the IntelliSages team dashboard.

Contact the IntelliSages Team

For partnerships, research collaborations, or inquiries, reach us at:

📧 intellisages@gmail.com

🌐 www.intellisages.com

Follow us for insights and updates:

X (Twitter): @IntelliSages

LinkedIn: IntelliSages

Wow, awesome.